The demand for raw materials used to manufacture rechargeable batteries will grow rapidly as the importance of oil as a source of energy recedes, as highlighted recently by the collapse of prices due to oversupply and weak demand resulting from COVID-19, according to a new UNCTAD report.

The report, Commodities at a glance: Special issue on strategic battery raw materials, documents the growing importance of electric mobility and the main materials used to make rechargeable car batteries.

Ongoing efforts to lower greenhouse gas emissions are expected to spur further investment in green energy production, which has been steady over the years, standing at around $600 billion per year on average.

“Alternative sources of energy such as electric batteries will become even more important as investors grow more wary of the future of the oil industry,” said Pamela Coke-Hamilton, UNCTAD’s director of international trade, launching the report.

Electric car sales have boomed in recent years, rising 65% in 2018 from the previous year to 5.1 million vehicles, and are expected to reach 23 million in 2030.

Electric car sales have boomed in recent years, rising 65% in 2018 from the previous year to 5.1 million vehicles, and are expected to reach 23 million in 2030, according to the International Energy Agency.

Rechargeable batteries will play a significant role in the global transition to a low-carbon energy system and help mitigate greenhouse gas emissions if the raw materials used in their manufacture are sourced and produced in a sustainable manner, the report says.

The worldwide market for cathode for lithium-ion battery, the most common rechargeable car battery, was estimated at $7 billion in 2018 and is expected to reach $58.8 billion by 2024, according to the report.

“The rise in demand for the strategic raw materials used to manufacture electric car batteries will open more trade opportunities for the countries that supply these materials. It’s important for these countries to develop their capacity to move up the value chain,” said Ms. Coke-Hamilton.

Raw materials in a few countries, value addition limited

Reserves of the raw materials for car batteries are highly concentrated in a few countries. Nearly 50% of world cobalt reserves are in the Democratic Republic of the Congo (DRC), 58% of lithium reserves are in Chile, 80% of natural graphite reserves are in China, Brazil and Turkey, while 75% of manganese reserves are in Australia, Brazil, South Africa, and Ukraine.

The highly concentrated production, susceptible to disruption by political instability and adverse environmental impacts, raises concerns about the security of the supply of the raw materials to battery manufacturers.

The UNCTAD report warns that supply disruptions may lead to tighter markets, higher prices, and increased costs of car batteries, affecting the global transition to low-carbon electric mobility.

According to the report, investing more in green technologies that depend less on critical battery raw materials could help reduce consumers’ vulnerability to supply shortfalls in the current mix of materials such as lithium and cobalt, but this would cut the revenues of the countries producing them.

The report indicates that the bulk of value added to raw materials used in making rechargeable batteries is generated outside the countries that produce the materials.

For instance, value added to cobalt ores by the DRC is limited to intermediate products or concentrates. Further processing and refining are mostly done in refineries in Belgium, China, Finland, Norway, and Zambia to obtain the end products used in rechargeable batteries as well as for other applications.

The DR Congo, which accounts for over two-thirds of global cobalt production, has not maximized the economic benefits of the mineral.

The DRC, which accounts for over two-thirds of global cobalt production, has not maximized the economic benefits of the mineral due to limited infrastructure, technology, logistical capacity, financing, and lack of appropriate policies to encourage local value addition.

The manufacture of positive electrodes for car batteries is dominated by countries in Asia. In 2015, China accounted for approximately 39% of the global market, Japan 19%, and the Republic of Korea 7%.

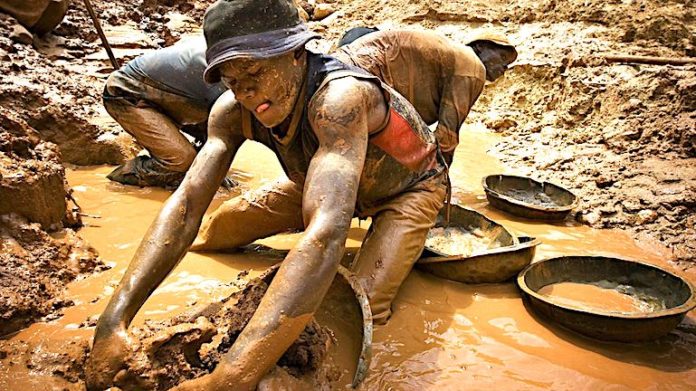

Social and environmental impacts stain production

The report shines a light on the social and environmental impacts of the extraction of raw materials for car batteries and underlines the urgent need to address them.

For instance, about 20% of cobalt supplied from the DRC comes from artisanal mines where child labour and human rights abuses have been reported. Up to 40,000 children work in extremely dangerous conditions in the mines for meager income, according to UNICEF.

And in Chile, lithium mining uses nearly 65% of the water in the country’s Salar de Atamaca region, one of the driest desert areas in the world, to pump out brines from drilled wells.

This has caused groundwater depletion and pollution, forcing local quinoa farmers and llama herders to migrate and abandon ancestral settlements. It has also contributed to environmental degradation, landscape damage, and soil contamination.

The adverse environmental impacts could be reduced by increasing investment in technologies used to recycle spent rechargeable batteries, according to the report.